CIT Founder Jay Benanav: Reporting Annuities on the FAFSA and CSS Profile

Do annuities count on the FAFSA & CSS Profile? It depends, says college money expert Jay Benanav.

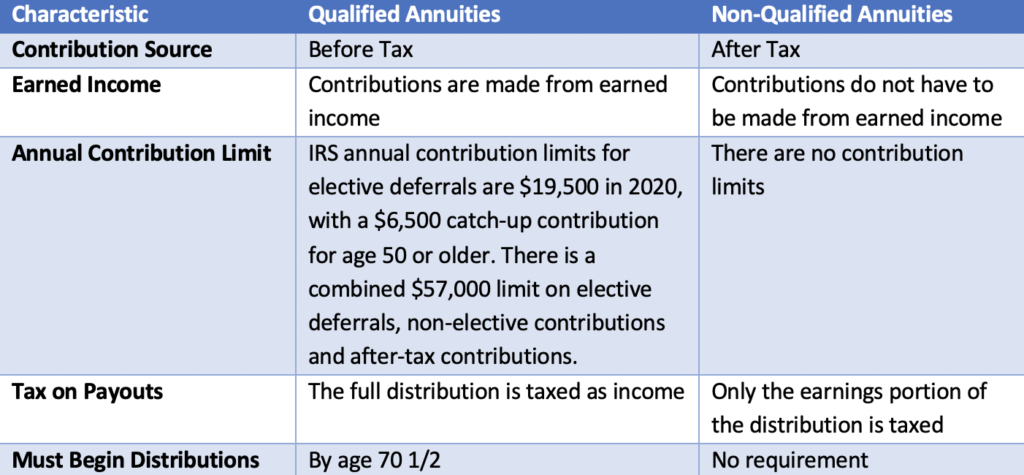

“Qualified” annuities do not get reported on the FAFSA but do get reported on the CSS. However, “nonqualified” annuities DO get reported on the FAFSA as well as the CSS.

This raises the question: What is the difference between a “qualified” & “nonqualified” annuity? Contributions to a qualified annuity are with before-tax dollars while contributions to a non-qualified annuity are with after-tax dollars.

So to determine if an annuity is reportable on the FAFSA, a prior determination has to be made on whether it is “qualified” or “non-qualified.” In practice, most annuities are “qualified”, but not always (so that is the “it depends” element of the answer).

Families should talk to whomever they bought the annuity from, or their financial planner, to determine which one it is.

Three generations of Benanavs.

Disclaimer: This interview sets forth general information. Check with your financial advisers.