Beware – Retirement savings rollover issue on FAFSA

There is a FAFSA issue that has been tripping up families with qualified retirement savings rollovers that can result in wildly inflated EFC’s (expected family contributions), thus reducing the amount of financial aid they qualify for.

There is a FAFSA issue that has been tripping up families with qualified retirement savings rollovers that can result in wildly inflated EFC’s (expected family contributions), thus reducing the amount of financial aid they qualify for.

Retirement savings moved from one qualified retirement plan to another qualified plan should not be reported as untaxed income on the FAFSA.

However, if a family uses the IRS Data Retrieval Tool (IRS DRT) embedded in the FAFSA, any rollover will be reported incorrectly as the IRS DRT does not identify and exclude tax return IRA and/or pension distributions that have been rolled over into another account.

If an amount greater than $0 is transferred from the IRS into the untaxed portions of IRA distributions field or the untaxed portions of pensions field on the FAFSA form, the family will be required to answer a new question about whether or not that amount includes a rollover.

If the answer is “yes,” the family will be required to provide the amount of the rollover in a new entry field. The amount reported as the rollover amount will then be subtracted from the amount of the IRA or pension distribution that was transferred from the IRS.

We’ve heard of many families who are missing the step of entering the amount of the rollover in the new field, or doing it incorrectly. In this case, it is advised to not try to correct the error because by changing any of the tax data, a family compromises the data transferred from the IRS.

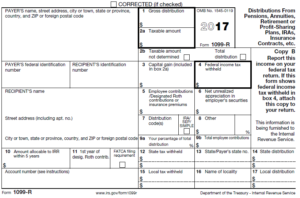

Instead, to correct any error, the family needs to work with the financial aid office at each of the colleges they’ve been accepted to and provide a copy of their IRS 1099-R form along with any other documentation requested by the schools.

Instead, to correct any error, the family needs to work with the financial aid office at each of the colleges they’ve been accepted to and provide a copy of their IRS 1099-R form along with any other documentation requested by the schools.