Filling out the FAFSA when there are divorced parents

Completing the FAFSA when parents are divorced is one of the most confusing scenarios for families, because custodial terms and who claims the child on the tax return do not necessarily apply.

Further complicating things is that the rules for divorced parents are changing along with a number of other key FAFSA changes starting with the 2024-2025 school year. This creates a scenario where many divorced families will qualify for significantly different levels of financial aid if their child is in college before and after the change.

Which parent info is provided on the FAFSA?

Currently, regardless of the legal custody arrangement, the divorced parent with whom the student lived with more in the past 12 months is who provides financial information on the FAFSA.

Importantly, both biological parents do not each need to provide their financial info on the FAFSA.

If time was split equally, then the parent who provided the most financial support for the last 12 months.

If still equal, then FAFSA instructs parents to talk with the financial aid office at the schools they are applying to for guidance.

Starting with the FAFSA completed for the 2024-2025 school year, this changes to which parent provides more financial support, regardless of where the child lives the majority of the time.

According to Mark Kantrowitz, current guidance issued by the U.S. Department of Education indicates that the parent with greater income will be responsible for completing the FAFSA when both parents provide equal financial support to the student.

Surprise! The remarried catch

Interestingly, while both biological parents do not include income and assets on the FAFSA, stepparent assets and income are included if the divorced parent completing the FAFSA has remarried.

So let’s say a student filling out the FAFSA in 2021 has divorced parents and she lives with her mom 100 percent of the time. Her dad, who has not remarried, does not need to provide any info for the FAFSA.

Her mom, who has remarried, needs to provide her total household income and assets on the FAFSA, which would include those of her new husband.

If her mom lives with a significant other but has not officially remarried, then only her information is provided on the FAFSA.

If your state recognizes common law marriage, and that applies for the divorced parent who is providing info on the FAFSA, then both the divorced parent and his or her common law spouse must provide their info on the FAFSA.

Dependent on tax return?

The scenario above is more confusing if the divorced dad, who does not live with the student, claims her as a dependent on his tax return.

While it seems logical for him to provide his info on the FAFSA, he still does not, as the rules for who completes the FAFSA versus dependency on the tax return are separate.

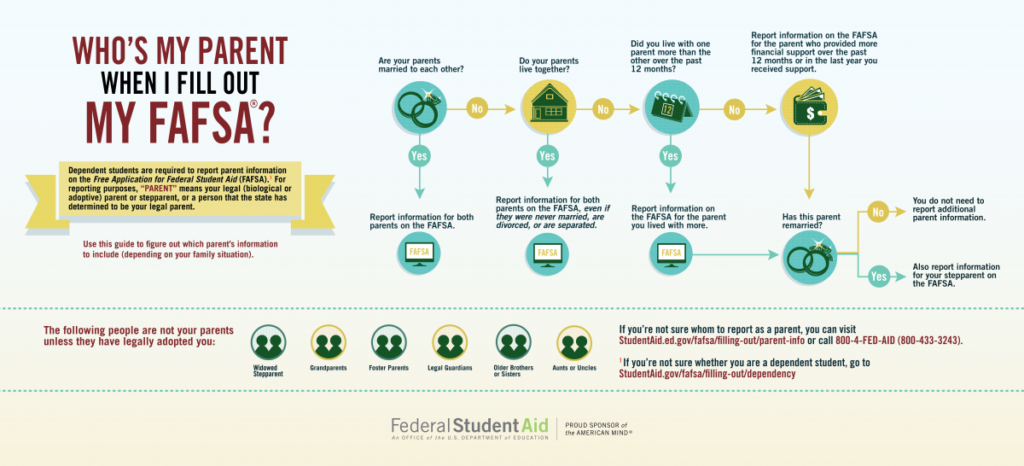

Check out this helpful infographic from the U.S. Department of Education for the current rules before the changes for the 2024-2025 school year go into effect:

Some colleges require forms other than the FAFSA

The advice above applies specifically for the FAFSA, but some colleges require other financial aid forms such as the CSS Profile or their own institutional aid form. In many cases, those forms will ask for financial information from both of the divorced parents.

Questions? Take advantage of College Inside Track’s free hour of personalized advice.

*This article was updated on June 17, 2021, to reflect the announced one year delay in implementation of the changes to the 2024-25 school year, due to the complexity of overhauling the entire system. The previous version had the changes occurring for the 2023-24 school year.