Shortcut to finding out how much the gov’t expects you to pay for college

College is a strange purchase, one of the few where you don’t know the final price until after you’ve done all the work.

Imagine shopping for a home the way most people shop for college. You’d spend months driving (or flying) all over looking at houses that were in a certain neighborhood or had certain amenities. You’d fall in love with one or two, show up for closing, and then you’d learn the price!

Imagine shopping for a home the way most people shop for college. You’d spend months driving (or flying) all over looking at houses that were in a certain neighborhood or had certain amenities. You’d fall in love with one or two, show up for closing, and then you’d learn the price!

Seems crazy right? I feel the same way about how people shop for college because they essentially do the same thing, only their teenage child is also a big driver of the decision.

But it doesn’t have to be that way. While they aren’t that easy to find, there are tools to help families predict the cost of certain colleges at the beginning of the process, so they can avoid wasting time on schools that are not a financial fit.

A key element of predicting cost is to understand one’s expected family contribution (EFC). This is the number a family gets after completing the FAFSA that tells them what the government expects them to contribute toward college out of their own pocket, before any loans or grants are awarded.

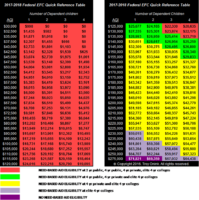

Troy Onink, CEO of Stratagee and frequent contributor to Forbes, put together the phenomenal quick reference table below for families to get an estimate of what their Federal EFC will be. You can read his entire 2017 guide to financial aid here.

For nearly every family I’ve worked with, the EFC completely shocks them (and not in a good way). To make matters worse, colleges get to use loans as a tool to make up the difference between their cost and the EFC, adding to the out-of-pocket cost. And some colleges don’t even provide a financial roadmap to meeting their entire cost, a process called “gapping” that again adds to the family’s total out-of-pocket cost.

So while EFC doesn’t tell the whole story, it is an important foundational piece for any family trying to figure out what schools may be affordable. The other component is the institutional aid the college provides to make up the difference between its price and a family’s EFC.

If a good chunk of that aid is in the form of grants and scholarships, either need-based or merit, that school can end up being quite affordable.

If not, well, it may be like showing up to close on your dream house — the one your kid fell completely in love with — only to find out it costs twice as much as you can afford.