Why is my EFC going up?

Talk about a double whammy!

Despite the rising cost of college, families are at the same time seeing an increase in their EFC (expected family contribution), which is what they are expected to contribute before any financial aid kicks in. In other words, a family with the exact same income and assets today as one from 10 years ago qualifies for less financial aid, despite college costing more!

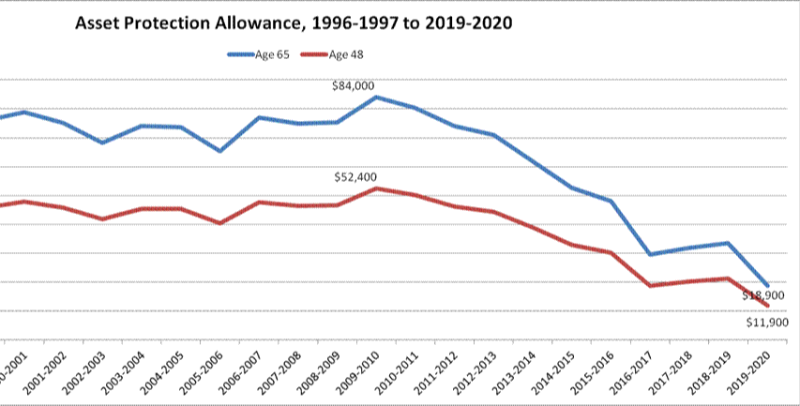

The story is told quite powerfully in this chart from savingforcollege.com.

Based on the age of the older parent, the FAFSA allows for some parental assets to be exempt from its financial aid eligibility calculation. According to savingforcollege.com’s Mark Kantrowitz, 48 is the median age of parents of college-aged children and 10 years ago, that family would have $52,400 of assets sheltered from the FAFSA (in addition to the value of their primary residence and qualified retirement accounts, which are entirely exempt).

Today a family with the oldest parent being 48 would only get $11,900 of assets sheltered. The $40,500 of additional assets that get assessed means the family may be expected to contribute a few thousand dollars more out of their pocket each year before they qualify for any financial aid.

Today a family with the oldest parent being 48 would only get $11,900 of assets sheltered. The $40,500 of additional assets that get assessed means the family may be expected to contribute a few thousand dollars more out of their pocket each year before they qualify for any financial aid.

The numbers get even worse as the age of the oldest parent rises. In the last 10 years, a 65-year-old parent has seen the asset protection allowance shrink by a whopping $65,100, which according to Kantrowitz could mean the equivalent of as much as a $4,258 cut in the student’s eligibility for need-based financial aid.

Unfortunately, there aren’t really any great solutions for families for this, other than cross their fingers that Congress decides to address it (…those fingers may still be crossed until well after the kids are out of college).